Business Ownership in Nigeria

Femi Oladele is an Educator and Consultant with solid background…

Introduction

This article explores business ownership in Nigeria specifically matters such as ownership and control, succession, taxation, charitable giving (CSR), public accountability, internal reporting, and registration requirements.

Is a business owner the owner because they are the owner i.e. because they contributed the main capital? What is (are) the limits of business ownership and how do you thrive in Nigeria owning a business?

Before we continue, I must mention that there is no best ownership type/structure. What you might get is how to determine what’s best for you (including your peace or better still your mental health and emotional balance) and your business – survival and sustainability amongst others.

Business Ownership Types in Nigeria

First, the fact that you proposed a business does not make you the overall boss. Also, your significant financial contribution does not automatically confer ownership. Business ownership in Nigeria has many dimensions, and ownership implications change with peculiar situations and decisions.

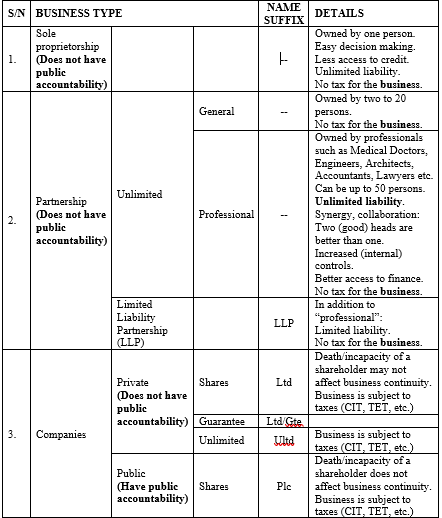

Before I delve into the specific implications, I will quickly highlight the business types in Nigeria:

Considerations

Founders want to know which business ownership type is preferable. Like I earlier mentioned, the most appropriate business type for you may change with time, location, and capacity of the business. For example, a merger or an acquisition potentially changes a business’ structure. You should consider the following when deciding what business structure to run with:

1. Funding consideration

Your funding decision will significantly influence the type of structure to start with. There are basically two funding models – debt and equity.

But you might say, I have gathered enough personal savings and donations to start – it is still debt since we hold a business as a separate entity to its owner(s). This position is limited with respect to sole proprietorship and unlimited partnerships in some situations.

If you decide to start with your personal savings, it is okay to consider a partnership or a private company structure. I intentionally omitted sole proprietorship, because I believe it is best to share risk even if it comes with its own risks too.

Considering equity? It means you are going for a company structure where other people can be part-owners with you and enjoy some levels of limited liability. Currently, in Nigeria, an individual (one person) can register a private company.

2. Liability Risk Preference

There are many business risks, but here I highlight liability risk. You should understand your risk preference as it helps you stand in the face of liability. Basically, there are two extremes – risk averse and risk takers. It has been argued that all entrepreneurs are risk takers because they take some levels of risks. While this is true, be true to yourself and know your limits.

Sole proprietorship structure exposes you to significant liability risks in the event of total loss of personal property or your inability to pay bills, which may even lead to bankruptcy.

Partnership structure minimises liability risk, while company structure eliminates the risk. It is best to use your risk score to determine which structure to start or run with. The good thing about business structures in Nigeria is that you can cross-carpet after meeting certain regulatory requirements.

3. Ownership Goal

Depending on your personal and/or family considerations, you might desire that ownership revolves within the family. For such desires, a partnership or private company structure are good options. If you do not mind allowing “outsiders” to have a stake in the business, partnership or private company options are good too.

I must quickly add here that ownership is different from management. Many people fear that if they are not practically involved in the management of an enterprise, their stake could diminish.

While this can be true, you can own stakes in an organisation and not be directly involved in its management but can appoint managers to carry out your strategic objective.

4. Tax Consideration

Currently in Nigeria, sole proprietorship and partnership structures are not taxable, but their owners and partners are liable to Personal Income Tax (PIT). In addition to the PIT, such structures would also pay Value Added Tax (VAT) on taxable goods and services acquired.

To shield your business from tax exposure, you may want to consider structures immune from taxes and grow from there. I must mention as well that small companies are sort of immune from some taxes that bigger companies must pay. There are also some tax incentives such as siting your business in a Free Trade Zone (FTZ) and/or applying for a pioneer status amongst other opportunities.

5. Survival and Sustainability

I usually advice owners of family business to consider transitioning to company structure when the arrowhead of their business is retiring without an interested family member.

For example, a great educational facility might go extinct if none of the children of the Proprietor is willing to take over leadership of the school.

In this case, the family can decide to transition to a company structure and allow capable hands to manage the business while the family interest is protected by ownership.

6. Profit Taking

Entrepreneurs may be interested in causes other than profit. For such causes such as health, art, or education, a business owner may wish to establish a not-for-profit entity.

This implies that a private company structure limited by guarantee may be a good option. However, if the motive is profit-making, then other structures are the way to go.

7. Public Accountability

Having public accountability implies that a reporting entity is required by Law to publish its financial statements and make it public.

The Securities and Exchange Commission (SEC), Corporate Affairs Commission (CAC), Nigerian Exchange Group (NGX) and other agencies of Government have powers to sanction erring companies – companies required to but who refuse to make their financial statements public within the stipulated timeframe.

All publicly listed companies have public accountability. However, I must note that there are limitations to the public accountability rule.

For example, Pension Fund Administrators (PFAs), most of who are private companies, must make the summary of their financial statements public because they are significantly important to the public, hence the name significant public interest entities (SPIEs).

Conclusion

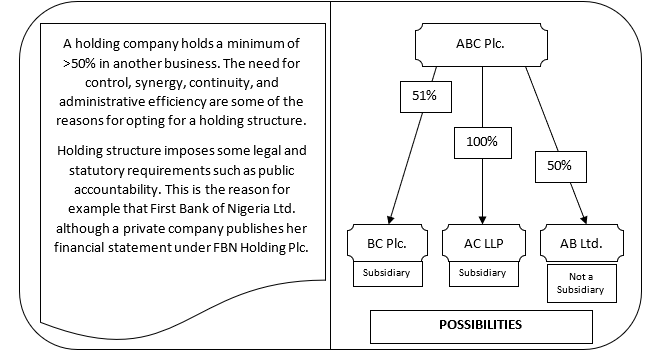

As I conclude this article, I must mention that business structures can be combined in a holding structure. If you follow structural changes in the financial services sector, you probably have read about Guaranty Trust Bank and Access Bank who have gone or are soon going from a standalone structure to a holding structure such that GT Bank Plc is now GTCO Plc. There are significant ramifications of a subsidiary and holding structure. I briefly explain it using the figure below:

As entrepreneurs, think about what’s best for you and your business, keeping in mind your current productivity and future considerations. For example, it’s easier to move from a partnership to a company structure, but maybe more administratively difficult to move from a public company structure to a partnership.

You have my best wishes as you decide on what business structure to undertake.

Further Readings

- Companies and Allied Matters Act (CAMA) 2020

- Companies Regulation 2021

- Nigeria Corporate Governance Code (NCGC) 2018